Insurance Software Specialists will design personal lines software to meet your general agency or company's specific needs. If you are a general agent writing through multiple companies, we can design the software to give the retail agents a comparative quote or display the rates for one company based on a series of rules. The web rating interface is designed for ease of use. There are customizable underwriting, rating, endorsement and discount screens. Automated underwriting is built into the software that will keep unacceptable risks from being quoted. Agents will be able to submit completed applications for underwriting approval. The program is designed to stop agents from submitting applications when required fields have not been filled. Underwriters will have the ability to override rules if the risk is deemed acceptable.

Most of the screens are tailored to have the look and feel of your website. Other features available include: Multiple dwelling rating capability on fire policies. Policy issuance that can allow a prospect to walk into an agents office and leave with a policy in a matter of minutes.

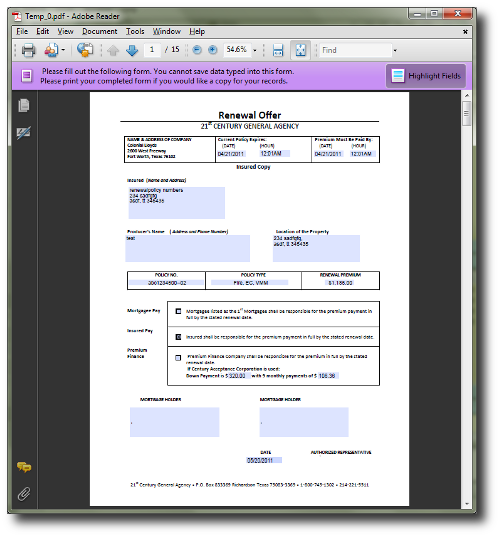

Renewal, endorsement, cancellation and reinstatement rating with printing of amended dec pages and endorsement forms. All forms can have the option of being printed in the agent's office or emailed to insured.

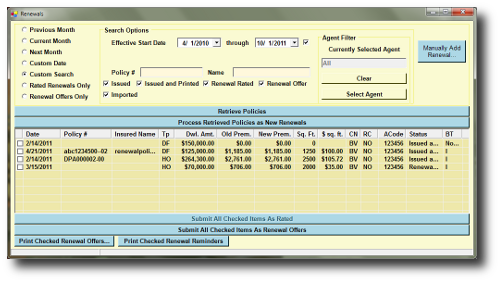

Automated Renewal rating will allow you to quickly process renewal offers.

Print out the forms directly from the program as PDF files.

Custom exporting functions that will move data to propietary agency management programs elminating double entry.

For Texas companies, we have a feature that will provide the TICO reporting data. Custom exporting functions that will move data to propietary agency management programs elminating double entry. Our programs can be run from a server on the clients end or Insurance Software Specialists can host the program.